An overview of bankruptcy practice and procedure

by Beth Smith

Law Offices of Elizabeth G. Smith

I. Introduction.

This paper is simply an overview of bankruptcy practice and procedure, with an eye toward consumer cases. If you are intending to practice bankruptcy law, you would benefit by attending an intensive Bankruptcy Seminar. You can look on the National Association of Consumer Bankruptcy Attorneys website for a thorough seminar at www.nacba.com.

The information in this paper is also focused on bankruptcy practice for the most part in the Western District of Texas and related local rules. Each district has different and sometimes peculiar local rules which the practitioner should become familiar. Information concerning the general overview of the bankruptcy practice has been gleaned not only from my experience as a debtor’s attorney in another life and currently as a creditor’s attorney but based on referral to the U.S. Bankruptcy Code and U.S. Bankruptcy Rules, the Local Bankruptcy Rules for the Western District of Texas, the Federal Rules of Civil Procedure and the Western District Bankruptcy website. This paper is meant as an overview to bankruptcy practice and rules and any reliance on the information contained herein is taken at your own risk. Enough with the disclaimer!

The reasons an individual or business files a bankruptcy case are varied, but the goal is to allow an honest debtor a fresh start, a new beginning, and a chance to address their financial “house” in an orderly fashion. Many debtors have been sued for collection of debts owed to creditors and they need to either find a way to repay the debt over a period of time or have the debt wiped out. Some debtors have a goal of reorganizing their business debt, ridding themselves of contracts that impair their ability to operate a business. Other debtors, individuals, and corporations alike, need a reprieve from tax debt and a way to repay that debt over a period of time. Whatever the reason, bankruptcy can allow an honest debtor a chance to avoid a property foreclosure, or eviction from their business space, find a way to repay debt, or rid themselves of debt and start anew.

II. General Terms and Concepts.

The general purpose of bankruptcy is to provide equal treatment of similarly situated creditors and provide the debtor with a discharge and fresh start.

Our bankruptcy system is rooted in the U.S. Constitution. U.S. Const. Art. 1, Sec. 8, Cl. 4 (authorizing Congress to enact “uniform Laws on the subject of Bankruptcies through the United States.”). Congress has enacted bankruptcy laws, with our current laws found under Title 11 of the United States Code, referred to as the Bankruptcy Code.

All references to the “Code” are to the Bankruptcy Code, which is the federal statute that provides the procedure for navigation of a bankruptcy case. Procedures encompass liquidation, reorganization, collection of assets, and creditor’s rights. All section references in this paper are references to sections within the Code. All references to the “Rules” or “Rule” are to the Federal Rules of Bankruptcy Procedure and will be referred to as “Rule”, which provide the road map on how to enact the Code provisions in a bankruptcy case.

A. Who are the Players?

- The Debtor is the individual or entity that petitions the Bankruptcy Court for protection from collection efforts of his/her or its creditors. The debtor may not only be individuals who are US citizens and foreigners, but also corporations, partnerships, municipalities, and other entities in some cases.

- The Creditor is the individual or entity owed a pre-petition debt by the debtor(s).

- The Trustee: In Chapters 7, 12, and chapter13, a Trustee is appointed by the United States Trustee in order to administer the case. The Trustee in these cases conducts the 11 U.S.C. 341(a) meeting of creditors, keeps records, makes reports and recommendations regarding each case and is primarily responsible for disbursement of the estate’s money to creditors which file claims. The Trustee has many other duties, but these are the basic functions. In a Chapter 11 case, a Trustee may be appointed, but only after a motion is made by a party in interest and it is so ordered by the Court, otherwise the debtor is referred to as the “debtor-in-possession” and serves the function of the Trustee, except in a Subchapter V Chapter 11 case, and a Trustee has a much more active role and is automatically appointed upon the filing of the case. In Chapter 11 cases the U.S. Trustee conducts the meeting of creditors.

B. What Does the Debtor Initially File?

The debtor files a Voluntary Petition, Creditor Matrix, Schedules which provide information concerning the debtor’s assets, debts and financial history and a Statement of Financial Affairs (“SOFA”) and other documents that provide a big picture view of the state of debtor on the petition date. Each Bankruptcy Chapter requires specific forms that may be different from other chapters, but the forms are designed to gather information from a debtor that is appropriate for the type of case being filed. The concept behind the documents to be filed by a debtor allow for full financial disclosure to the world. Official Bankruptcy forms and local forms can be found on the District’s website.

C. Where Does the Debtor File the Case? Venue.

The proper venue for a bankruptcy filing is provided in28 U.S.C. §§ 1408-1452. The bankruptcy case can be commenced in the district where the debtor domiciles, resides, has principal place of business, or has principal assets within the past 180 days prior to the filing of bankruptcy. 28 U.S.C. 1408. Alternatively, venue is also proper where a bankruptcy case is pending for one of the debtor’s affiliates, general partners, or partnership. 28 U.S.C. 1408(2). A basis for many of the large Chapter 11 cases filed in New York or Delaware can be due to a relatively insignificant affiliate that maintains its business in such jurisdictions primarily for purposes of choice of venue. Legislation has been proposed to try to maintain bankruptcy cases closer to a venue where more creditors likely will exist, instead of distant venues that are more cost prohibitive for creditors to participate in the case. Venue can be changed in the interest of justice or the convenience of the parties. 28 U.S.C. § 1412. For certain non-consumer debt claims filed against a third-party defendant, such as preference claims typically, if the amount seeking to be recovered is less than $25,000, venue lies where the defendant resides. 28 U.S.C. § 1409(b).

D. Types of Bankruptcies.

Five chapters for qualifying debtors exist under Title 11 – Chapters 7, 9, 11, 12, 13, and 15. The most common chapters that we see are Chapter 7, 11, or 13, as Chapter 9 applies to municipalities, Chapter 12 applies to family farmers (including ranchers) and fisherman, and Chapter 15 applies to cross-border bankruptcies.

Individuals can file under Chapter 7, 11, 12 and 13. Entities can only file petitions for Chapters 7 and 11, 12 and 15 cases. Chapter 12 is limited by the owner of the outstanding stock or equity.

1. Chapter 7 is a total liquidation of an individual’s non-exempt assets or a business, by a trustee in which individual debtors receive a discharge and retain their exempt assets. A Chapter 7 debtor cannot receive a discharge if a prior discharge was received within 8 years of the new filing.

2. Chapter 9 is the adjustment of debts of a municipality.

3. Chapter 11 is a traditional business reorganization but is also available to certain individuals. A trustee is not automatically appointed, unless a Subchapter V Chapter 11 case is filed. Instead, the debtor remains in control as “debtor-in-possession” or “DIP” for short and becomes a fiduciary to their creditors. A creditor can move for appointment of a trustee if there is a good reason, such as the DIP mismanaging the property or self-dealing. The debtor retains the use of its property and attempts to provide for full or partial payment of creditors’ claims through a plan of reorganization. The plan of reorganization can effectuate a restructuring of the debtor’s business and capital structure or an orderly liquidation of the debtor’s property. Although Chapter 11 relief is available to individuals, it is primarily used by businesses seeking to continue operations while restructuring debt or to liquidate in an orderly fashion. However, unlike a Chapter 7 case, Chapter 11 corporate debtors receive a discharge, with some exceptions, but only when the reorganization plan is confirmed, and for individuals only after completion of all plan payments and only if a debt has not been excepted from by a §523action. See 11 U.S.C. §1141.

4. Two Chapter 11 sub-types of cases exist as follows:

i. Small Business Case created under the Bankruptcy Abuse and Consumer Protection Act of 2005 (“ BAPCPA”), effective October 17, 2005, is “a case filed under Chapter 11 of this title in which the debtor is a small business debtor and has not elected that subchapter V of chapter 11 of this title shall apply.” 11 U.S.C. §101(51)(C). A Small Business Debtor is limited by amount of aggregate noncontingent liquidated secured and unsecured debts of not more than $3,024,725 (excluding debts owed to 1 or more affiliates or insiders) and limitations as to affiliated debtors. See 11 U.S.C. §101(51D).

ii. On February 19, 2020 the Small Business Reorganization Act (“SBRA”) became effective, adding Chapter V to Chapter 11 of the Code. See 11U.S.C. §1181, et seq. The purpose of SBRA was to provide an avenue for an individual or business with less complex business issues and less debt to receive relief with the goal of confirming a plan. SBRA removes the need for a creditor’s committee, a disclosure statement and requires a plan to be filed in 90 days from the date of the case filing. Think of this as a Chapter 13 for businesses and individuals with higher debt limits.

A Sub-chapter V debtor is limited by amount of aggregate noncontingent liquidated secured and unsecured debts of not more than $7,500,000, due to the CARES Act, (excluding debts owed to 1 or more affiliates or insiders) and limitations as to affiliated debtors. The case cannot be a single asset real estate case. The debt limit expires on June 21, 2024 and reverts to $2,725,625. See 11 U.S.C. §1182.

5. Chapter 12 is a reorganization designed for “family farmers[1]” or “family fishermen” with “regular annual income.” See 11 U.S.C. §§ 101(18), 101(19A), 109(f). Chapter 12 enables financially distressed family farmers and fishermen to propose and carry out a plan to repay all or part of their debts. Under Chapter 12, debtors propose a repayment plan to make installments to creditors over three to five years. Generally, the plan must provide for payments over three years unless the court approves a longer period “for cause”. In no case may a plan provide for payments over a period longer than five years.

6. Chapter 13 is a reorganization for individuals with regular income, who owes, on the date of the filing of the petition, non-contingent, liquidated debts of less than $2,750,000 or an individual with regular income and such individual’s spouse, except a stockbroker or a commodity broker, that owe, on the date of the filing of the petition, non-contingent, liquidated debts that aggregate less than $2,750,000. See 11 U.S.C. §109(e). If the dollar limits are exceeded the individual(s) will not qualify to file a Chapter 13 case. The debtor(s) will receive a discharge after the payout plan is fully completed. A discharge will not be granted in Chapter 13 if the debtor obtained a discharge in Chapter 7, 11 or 12 within the 4 years prior to the date of filing of the pending case, or in a Chapter 13 case filed within 2 years of the pending case. This provision, though, does not prevent the debtor from filing a Chapter 13 case, and receiving the benefits of the stay, including the ability to cure arrearage sums on secured claims over a period of time.

7. Chapter 15 was added by BAPCPA in 2005. Chapter 15 establishes procedures for dealing with ancillary and cross-border insolvency cases. It is the U.S. domestic adoption of the Model Law on Cross-Border Insolvency promulgated by the United Nations Commission on International Trade Law (“UNCITRAL”) in 1997, and it replaced section 304 of the Bankruptcy Code. The purpose of Chapter 15, and the Model Law on which it is based, is to provide effective mechanisms for dealing with insolvency cases involving debtors, assets, claimants, and other parties of interest involving more than one country. Generally, a Chapter 15 case is ancillary to a primary proceeding brought in another country, typically the debtor’s home country. As an alternative, the debtor or a creditor may commence a full Chapter 7 or Chapter 11 case in the United States if the assets in the United States are sufficiently complex to merit a full-blown domestic bankruptcy case. See 11 U.S.C. § 1520 (c). In addition, under Chapter 15 a U.S. court may authorize a trustee or other entity (including an examiner) to act in a foreign country on behalf of a U.S. bankruptcy estate. See 11 U.S.C. § 1501, et seq.

E. Petition Date.

The petition refers to the pleading that is filed to commence a bankruptcy case, whether voluntary or involuntary. The filing date of the petition is referred to as the “petition date.” This date is significant because it defines the “estate” or assets that debtor owned on the petition date; the debts and liabilities debtor owed on the petition date; and the date on which all actions against or by debtor must cease until further order of the bankruptcy court. The terms “pre-petition” and “post-petition” are used to refer to matters, like claims, assets, and actions. “Pre-petition” matters are those arising before the bankruptcy petition date and “post-petition” matters are those arising after the bankruptcy petition filing date.

F. Debtor in Possession or Dip.

Unlike a Chapter 7 case, no trustee is automatically appointed in a Chapter 11 case. Instead, the debtor remains in control as a “debtor-in-possession,” or “DIP” for short, and becomes a fiduciary to their creditors. 11 U.S.C. § 1107(a); see also In re Nadler, 8 B.R. 330, 333 (Bankr. E.D. Pa 1980); In re Thu Viet Dinh, 80 B.R. 819 (Bankr. S.D. Miss. 1987). The Code uses the term “trustee” in numerous sections. When there is a DIP and no trustee assigned to the case, the term “trustee” used in the Code generally refers to the DIP. See 11 U.S.C. § 1107; ASARCO LLC v. Americas Mining Corp., 396 B.R. 278, 325 & n. 32 (Bankr. S.D. Tex. 2008). For purposes of this paper the term “debtor” will be used to define a debtor under any chapter of the bankruptcy code.

G. Resources.

Websites: An important aid to the bankruptcy practitioner can be found on each bankruptcy district website provided to the public. The Bankruptcy Courts in all districts in the United States provide a website which can be accessed by typing the abbreviation of the state, then the first letter of the district in which the court is located and the letter “b” for bankruptcy, plus “uscourts.gov”. For example: the website for the Western District of Texas http://www.txwb.uscourts.gov. Each website is different but you are able to access the most current Local Rules, Appendix, Standing Orders, forms, announcements, names and addresses of bankruptcy courts and judges, general information concerning bankruptcy law and practice, judges hearings calendar, divisional office directories, filing fee schedule, case filing reports and important links can be found at this website.

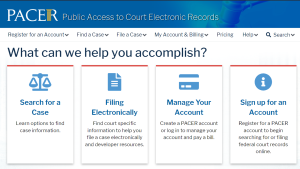

PACER is an electronic public access system that allows you to use a terminal or computer and modem to dial in to a special public information computer and directly access official bankruptcy case information. You can save information about thousands of cases on your own computer or print it out in your office without having to visit any of the court’s divisional offices in the United States. PACER can be used when you want quick, accurate information about cases filed in all Bankruptcy cases.

PACER is an electronic public access system that allows you to use a terminal or computer and modem to dial in to a special public information computer and directly access official bankruptcy case information. You can save information about thousands of cases on your own computer or print it out in your office without having to visit any of the court’s divisional offices in the United States. PACER can be used when you want quick, accurate information about cases filed in all Bankruptcy cases.

What information is available through PACER?

Case information – query and download capabilities are available for all pending, recently closed, and archived cases. You can access this information by case number or debtor name.

Archived Information: Case Information for cases closed prior to 1/1/97.

New Debtor Listings.

Credit Matrices for all pending and recently closed cases.

Claims Registers for all bankruptcy cases except Chapter 7 no-asset cases.

Archived Case File Accession/Location Numbers.

Closed Bankruptcy Case Reports on a daily or monthly basis.

The information in the PACER system is updated at the end of each working day with current information from the court’s BANCAP application system.

III. What Happens When the Bankruptcy Petition Is Filed?

A. The Automatic Stay:

Once a debtor files a bankruptcy petition, an injunction or what is called the “automatic stay” is issued to protect the debtor from creditors. The automatic stay requires all collection efforts, any harassment, and all foreclosure actions to be immediately stopped by creditors when the case is filed. The automatic stay permits the debtor to attempt a repayment plan or simply to be relieved of the financial pressures that drove the Debtor into bankruptcy. The automatic stay also protects creditors. Without the automatic stay, certain creditors would be able to pursue their own remedies against the debtor’s property. The creditors who acted first would obtain payment of the claims in preference to and to the detriment of other creditors. Bankruptcy is designed to provide an orderly liquidation procedure under which all creditors with equal rights are treated equally. Parties who violate the automatic stay can, under certain circumstances, be held liable for damages and may be held in contempt of court.

The automatic stay is limited in situations involving bad faith and “serial filers”; debtors who fail to timely file a statement of intent with respect to property subject to a security interest; debtors whose property has already been subjected to a lift stay motion in a previous case; and debtors involved in a residential eviction proceeding where a judicial determination was decreed prior to the bankruptcy filing, subject to cure provisions found in 11 U.S.C. §342(l); and debtors involved in a residential eviction proceeding based on endangerment or drugs.

Limit on Automatic Stay §362

The application of the stay does not go into effect in certain circumstances, such as serial filings that are considered bad faith or abusive filings. See11 U.S.C. §362(c)(3). Specifically, the stay terminates after 30 days if a case is filed by an individual in Chapter 7, 11 or 13 (but not Chapter 12) within 1 year after the prior case (under any Chapter) was dismissed (except for a case re-filed in another chapter after a dismissal of a Chapter 7 case based on the means test). Id. A party in interest (including the debtor) may move to extend the stay and show that the filing is in good faith. A case is presumed to be in bad faith for this purpose if more than one case was pending in Chapters 7, 11 or 13 (again, not in Chapter 12) and at least one such case was dismissed for failure to file required documents without substantial excuse, to provide adequate protection, or to complete a plan, and there is no showing that the debtor’s financial situation has changed so as to allow a final discharge or completion of a plan. See11 U.S.C. §362(c)(3)(B). If two or more cases under any Chapter were dismissed during the prior year, the automatic stay does not go into effect at all until the court so orders after a hearing and a demonstration that the filing was made in good faith. See11 U.S.C. §362(c)(4)(B). The same bad faith factors noted above are also applicable to this determination. The law also provides that the stay will terminate if the debtor does not timely file (i.e., within 30 days after the petition date) its statement of intent with respect to property subject to a security interest and timely (i.e., within 30 days after the first date set for the §§341 meeting) complies with the stated intention. The court may extend the stay upon the motion of the trustee if the property is of value to the estate and adequate protection is afforded to the creditor.

B. Creation of Bankruptcy Estate.

Upon the filing of the Voluntary Petition an “estate” is created comprised of all of Debtor’s legal or equitable interest in property, wherever located and by whomever held. See11 U.S.C. §541. As such, Debtor must list every interest held and owned, sold, or transferred on the Schedules and Statement of Financial affairs. The lookback period for transfers to be disclosed by a debtor can be as long as ten years prior to the petition date.

The Trustee’s duties are comprehensive to administer the estate. See11 U.S.C. §541 (a). These duties are far reaching and provide the Trustee with the power to liquidate property that is non-exempt; investigate the financial affairs of debtor; pursue claims for transfers of property that are considered preferential or fraudulently transferred; oppose the discharge of debtor if warranted, examine proofs of claim and object to the allowance of the same; collect assets and money; pay claims; and report to the Court the actions taken.

C. Notice of Commencement of Case:

The Bankruptcy Clerk issues a notice entitled “Commencement of Case”, (“Notice”), which is mailed to all creditors and parties in interest which debtor has listed on the Creditor Matrix. The Notice provides the creditor or party in interest with important case information: the name and address of the debtor(s); the date the case was filed and the automatic stay went into effect; the name, address and phone number of debtor’s attorney; the date of the § 341 (a) Meeting of Creditors; whether the case is an asset or no asset case; whether to file a proof of claim and if so the deadline for filing the claim; deadline for objecting to the individual debtor’s exemptions; and deadline for objecting to the individual debtor’s discharge or dischargeability of a specific debt. If the debtor lists the case as an asset case, then a proof of claim form will be provided on the back of the Notice. In a Chapter 13 case in addition to the same information, a deadline to object to the Chapter 13 Plan is provided.

D. 341(A) Meeting of Creditors

The 341(a) Meeting or Meeting of Creditors is scheduled shortly after the filing of debtor’s petition. Each case must have a 341(a) Meeting of Creditors and the debtor must attend this meeting. The trustee or the U.S. Trustee will conduct the meeting at which the debtor may be examined by the creditors to inquire about the debtor’s financial status, the debtor’s conduct and financial affairs, and any other matters which are relevant to the administration of the debtor’s estate, including factors which bear on an individual debtor’s right to a discharge or to the dischargeability of any particular obligation, or the debtor’s claimed exemptions. The trustee may continue the 341 meeting if the trustee needs additional information, the debtor has failed to file all necessary documents, the trustee needs more time to review the debtor’s information or creditors have not had adequate time to question the debtor. At this time, all Chapter 7 and 11 creditor’s meetings are conducted by telephone and all Chapter 12 and 13 cases are conducted virtually by Zoom.

E. Deadlines

- Objection to Exemption Claim

Creditors have 30 days from the first date of the Meeting of Creditors to object to an individual debtor’s claim of exempt property. debtor’s claim of exemptions are based upon state exemptions found in the Texas Property Code §41.001 and 42.001 or federal exemptions found in 11 U.S.C. §522 of the Bankruptcy Code.

- Objection to Discharge or Dischargeability

Creditors have 60 days from the date of the 341(a) Meeting of Creditors, to file a lawsuit objecting to the debtor receiving a discharge (all debts, 11 U.S.C. §727) or specific debts (11 U.S.C. §523) being discharged. The filing of such a lawsuit triggers the commencement of an adversary proceeding, which is assigned a proceeding number different from the case number.

- Objection to Confirmation of Chapter 13 Plans

Amended Standing Order Relating to Chapter 13 Practices in the San Antonio Division dated August 5, 2016, provides that any objections to confirmation of the plan, must be filed fourteen (14) days before the Confirmation hearing in writing. Failure to affirmatively object to a proposed plan pursuant to the requirements of this paragraph constitutes acceptance of the plan under 11 U.S.C. §1325(a)(5)(A).

F. Filing A Proof of Claim

A proof of claim is broadly defined in the Code. See 11 U.S.C. §101(5). It includes a right to payment, whether such right is liquidated or unliquidated, matured or unmatured, contingent, or disputed. Id.

In a chapter 7 asset case the deadline for filing claims is 90 days from the first date set for the 341(a) Meeting of Creditors or 90 days from the date entered on a “Notice Setting Bar Date”.

In a chapter 13 case, a proof of claim by a secured creditor, other than a governmental agency, is timely filed if it is filed by the creditor not later than 70 days after the order for relief/petition date. Governmental Units are allowed until 180 days from the order for relief. See Bank. R. 3002(c). Failure to timely file the secured claim shall be without prejudice, nevertheless, to the creditor’s right to seek relief from the automatic stay under Section 362 or adequate protection payments under Section 363 of the Bankruptcy Code.

Proofs of claim or interests in Chapter 11 cases shall be filed by the date established in the Notice of the Meeting of Creditors pursuant to §341, unless the Court, upon motion and after notice and an opportunity for hearing, orders otherwise.

Types of Claims: In bankruptcy, there are generally the following types of claims: secured, super priority, administrative expense priority, unsecured, and equity. The priority of the claim or the order of which the claim gets paid in relation to the other claims, depends on the type of claim. Secured creditors are entitled to the value of their collateral. Super priority claims are granted through a court order, generally because of a lender providing post-bankruptcy financing to the debtor. See 11 U.S.C. § 507(b). Administrative expenses claims are generally paid ahead of all creditors and consist of claims associated with administration of the bankruptcy case such as the debtor’s lawyers’ fees and an application to allow the claim is required. 11 U.S.C. § 503. Unsecured claims refer to all claims that are not otherwise secure, administrative or priority. Equity refers to ownership interest in the debtor. The priority scheme under the Code is outlined in 11 U.S.C. §507.

A claim should be filed for your client to establish the debt owed by the debtor and the priority of your client depending on whether the claim is secured or unsecured.

G. Contested Matters and Adversary Proceedings.

There are two types of proceedings in bankruptcy – contested matters and adversary proceedings. A contested matter is motion practice within the main bankruptcy case. An adversary proceeding is a new distinct lawsuit and proceeding related to the main bankruptcy case and assigned a separate case number. The underlying document filed to initiate the adversary case is a complaint, which requires service of a summons and all the requirements of due process associated with a lawsuit.

Bankruptcy Rule 7001 enumerates ten types of proceedings that must be filed as adversary proceedings are the following:

Recover money or property (likely debtor or any other party);

Determine the validity, priority, or extent of a lien or other interest in property (likely debtor, trustee, creditor or any party);

Obtain approval pursuant to 363 (h) for the sale of both the interest of the estate and of a co-owner in property (usually filed by the trustee or a creditor, but also can be filed by the debtor);

Object to or revoke a discharge (likely filed by the trustee or a creditor);

Revoke an order of confirmation of a plan (likely filed by the trustee or a creditor);

Determine the dischargeability of a debt (likely filed by a creditor);

Obtain an injunction or other equitable relief (likely filed by trustee, creditor, debtor or third party);

Subordinate any allowed claim or interest, except when subordination is provided in the plan (likely filed by debtor or creditor);

Obtain a declaratory judgment relating to any of the foregoing;

Determine a claim or cause of action removed to Bankruptcy Court in accordance to 28 USC 1452.

If a proceeding does not fit within the ten categories enumerated in Rule 7001, then it is a contested matter under Rule 9014.

An adversary proceeding may be filed by the debtor, the trustee, or any party in interest.

If your client should choose to file an adversary proceeding objecting to the debtor’s discharge or dischargeability, your client should know that it may win the case, but not be able to collect a penny from the debtor as the Texas exemptions are quite generous in providing protection of personal and real property owned by the debtor.

H. Exemptions: Very Important in an Individual Case.

Two key reasons an individual files a bankruptcy case is to rid themselves of debt and keep as much real and personal property as possible. A debtor’s claim of exemptions are based upon state exemptions found in the Texas Property Code §§41.001 and 42.001 or federal exemptions found in 11 U.S.C. §522 of the Bankruptcy Code. Remember that all property owned by Debtor when the case is filed is considered property of the bankruptcy estate. However, Debtor is allowed to claim exemptions using either the State or the Federal Exemptions to take the property out of the bankruptcy estate.

The “Twist” is if you are “new” to Texas: In 2005 the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (“BAPCPA” or Bankruptcy Reform Act”) was enacted which limits debtors’ use of state exemptions based upon the state in which debtor lived for the 730 days prior to the bankruptcy filing. See § 522(b)(3). If debtor moved during that 730-day period, the state exemptions that can be claimed are from the state in which the debtor lived the majority of the time for the 180 days before the 730-day period. Regardless of the level of state exemptions, the debtor may only exempt up to $155,675 of interest in a homestead that was acquired within the 1,215-day period prior to the filing, but the calculation of that amount does not include any equity that has been rolled over during that period from one house to another within the same state. See 11 U.S.C. §522(p)(1). The right to claim $155,675 is for each debtor. The reason is to restrict the “mansion loophole” that allows debtors living in certain states to shield all of the equity in their homes from their creditors by relocating to states that have generous homestead exemption. See discussion of Odes Kim v. Dome Entertainment Center, Inc. (In re Kim) below.

IV. Wild Card and Miscellaneous Matters

A. Be Careful Who You Do Business With!

February 22, 2023: Bartenwerfer v. Buckley; NO. 21-908, Slip op. Feb. 22, 2023, 598 U.S. __(2023). In a unanimous opinion, the Supreme Court found that debts arising from another person’s fraud can be imputed to a co-obligor who did not actively engage in the fraud. The debtors are husband and wife, purchased a home, remodeled it and then sold it to Buckley. However, Mr. Bartenwerfer failed to disclose defects in the home. After a state court judgment was taken against the Bartenwerfers based on fraud, the husband and wife filed a Chapter 7 case to discharge the debt. Unfortunately, the falsity of the representations and the intent to deceive were not litigated in the state court case, so Buckley had to seek findings on these issues with the Bankruptcy Court in order to qualify for collateral estoppel.

Many rulings and appeals later, the Supreme Court considered Bankruptcy Code §523(a)(2)(A) was written in a passive voice and does not “specify a fraudulent actor”. [2] The plain grammatical reading of 11 U.S.C. §523(a)(2)(A) may impact spouses and business partners beyond imagination.

Take away: be careful with whom you partner, in marriage and otherwise. The Bartenwerfer v. Buckley decision can be especially harmful to the spouse who is not involved in a business.

B. Character of Property:

Confirm that your client really does own a qualified retirement account, an IRA, a 401(k), not just a savings account to use for retirement. Texas exemptions do not provide an exemption for money, so the account would need to be liquidated and a check handed to the Trustee in a Chapter 7 case. Federal exemptions do provide a wildcard sum to be used for cash.

C. What Happens if a Debtor Dies and a Bankruptcy Case is Pending?

Rule 1016 provides: Death or incompetency of the debtor shall not abate a liquidation case under chapter 7 of the Code. In such event the estate shall be administered and the case concluded in the same manner, so far as possible, as though the death or incompetency has not occurred. If a reorganization, family farmer’s debt adjustment case is pending under chapter 11, chapter 12, or chapter 13, the case may be dismissed; or if further administration is possible and in the best interest of the parties, the case may proceed and be concluded in the same manner, so far as possible, as though the death or incompetency had not occurred. So, the case can be continued and this may be an efficient way to liquidate the debts as opposed to a full blown probate.

D. Inherited IRAs are not Exempt Property

Inherited IRAs do not qualify as exempt property. Clark V. Rameker, 573 U.S. 122, 134 S.Ct. 2242; 189 L. Ed. 157) (2014). The Supreme Court compared the characteristics of an IRA, both traditional and Roth to an inherited IRA. A traditional IRA is created under 26 U.S.C. § 408 for the purpose of encouraging individuals to save for retirement with the following characteristics:

- Tax deductible qualified contributions;

- Withdrawals taken before account holder reaches age 59 ½ are subject to a 105 penalty; and

- Capital gains and dividends on contributions are taxes upon withdrawal.

Inherited IRA is transferred to a beneficiary upon the death of the traditional or Roth IRA account holder under 26 U.S.C. § 408 with the following characteristics:

- Withdrawals at any time without incurring a penalty;

- No allowance for contributions; and

- Withdraw entire balance within five years or take minimum distributions on annual basis.

After the comparison of the characteristics of a traditional or Roth IRA and an inherited IRA, the Supreme Court distinguished that an inherited IRA is “not objectively set aside for the purpose of retirement.” Clark, 134 S.Ct. at 2247. As such, Traditional and Roth IRAs “ensure that debtors who hold such accounts … do not enjoy a cash windfall by virtue of the exemption”, while an inherited IRA does not ensure the same result. Id. at 2248. Instead, nothing about the inherited IRA’s legal characteristics would prevent (or even discourage) the individual from using the entire balance of the account. Id.

Take away: the putative debtor must be aware of an income stream that could be lost if a bankruptcy case is filed.

E. Is It Really a Spendthrift Trust?

Make sure the trust’s settlor is also not a beneficiary of the trust. Otherwise, the trust will not be exempt from the Trustee reaching the assets of the trust. Under Texas law, a spendthrift provision in a trust protects trust property from the beneficiary’s creditors unless “the settlor is also a beneficiary of the trust.” TEX. PROP. CODE § 112.035(d); see also Bradley v. Ingalls (In re Bradley) 501 F.3d 421, 428 (5th Cir. 2007) citing, Shurley v. Texas Commerce Bank-Austin, N.A. (In re Shurley), 115 F.3d 333, 337-38 (5th Cir. 1997). The “self-settlor rule” will prevent a debtor from avoiding creditors by creating a spendthrift trust and naming himself as a beneficiary.

F. Inheritance

A debtor has an affirmative duty to disclose a post-petition inheritance. See FRBP 1007(h) which specifically states: “If, as provided by 11 U.S.C. §541(a)(5) of the Code, the debtor acquires or becomes entitled to acquire any interest in property, the debtor shall within 14 days after the information comes to the debtor’s knowledge or within such further time the court may allow, file a supplemental schedule in Chapter 7, liquidation case, Chapter 11 reorganization case, Chapter 12 family farmer’s debt adjustment case, or Chapter 13 individual debt adjustment case. If any of the property required to be reported under this subdivision is claimed by the debtor as exempt. The debt shall claim the exemptions in the supplemental schedule.” The duty continues even after the case is closed, except for property acquired after an order is entered.

Inheritance Within 180 Days of Filing

11 U.S.C. §541(a)(5) provides that “property of the estate” includes “any interest in property that would have been property of the estate if such interest had been an interest of the debtor on the date of filing of the petition, and that the debtor acquires or becomes entitled to acquire within 180 days after such date—

(a) by bequest, devise or inheritance; or

(b) as a beneficiary of a life insurance policy or of a death benefit plan.”

In a chapter 13 case, 11 U.S.C. §1306(a) will bring in inheritance more than 180 days post-petition as property of the estate notwithstanding 541(a)(5). In re Carroll, 735 F.3d 147 (4th Cir. 2013).

G. Life Insurance Policies Interest of Husband-and-Wife Debtors

In re Paul Daniel Meinscher and Mildred Lillian Meinscher (In re Meinscher), No. 22-50925-cag, 2023 WL 1999098 (Bankr. W.D. Tex. Feb. 14, 2023). Joint Chapter 7 debtors filed an amended schedule listing state law exemptions, including their interests in two life insurance policies under Texas insurance Code §§ 1108.001 and 1108.051. The Chapter 7 Trustee objected to the joint debtors’ exemption of those interests on multiple grounds, but the bankruptcy court found that the Trustee had not met his burden. The Court distinguished the cash value of an existing life insurance policy from cash paid out on a surrendered life insurance policy, stating that the Trustee’s objection would apply to the latter and not the former. Further, the Court cited to the Fifth Circuit for the contention that contingent rights of beneficiaries in existing life insurance policies can be exempted, overruling the Trustee’s argument that beneficiaries cannot avail themselves of the exemption until after an insured has died.

Last: Bad Facts Make for Bad Results

Debtors Lose Their Homestead:

Odes Kim v. Dome Entertainment Center, Inc. (In re Kim) 748 F.3d. 384 (5th Cir. 2014). A non-debtor spouse’s homestead interest was limited to the dollar amount of the exemption allowed for the filing spouse, who had owned the house less than 1215 days from the date an involuntary bankruptcy was filed. Looking to Texas homestead law, the court ruled Mrs. Kim’s homestead right had some value, but no cases were submitted to determine the calculation, so none was made as to Mrs. Kim’s interest. (Remember, each spouse can claim the exemption amount.) Finally, the 5th Circuit ruled that the homestead could be sold and the same action was not an unconstitutional taking of Mrs. Kim’s interest in the homestead.

Some factors that made this case bad for Mrs. Kim:

- Mr. Kim bought the house in his name only, less than 1215 days before the involuntary bankruptcy was filed;

- Mr. Kim was in litigation with Dome Entertainment when he bought the home and two years later a judgment in the sum of $500,000 was taken against him;

- The purchase price of the home was $1,048,028.36;

- Mr. Kim tried to claim an unlimited homestead exemption.

The Kims stipulated that the home was either a) Mr. Kim’s separate property, b) Mr. Kim’s sole management community property, or c) the join management community property of both the Kims. Mr. Kim’s homestead exemption was limited to $136,875, which was the limitation at the time of the involuntary bankruptcy. ♦

[1]The term “farming operation” includes farming, tillage of the soil, dairy farming, ranching, production or raising of crops, poultry, or livestock, and production of poultry or livestock products in an unmanufactured state. See 11 USCS § (21).

[2]Bartenwerfer v. Buckley, No. 21-908, slip, op. At 4 (U.S. Feb. 22, 2023).